Terrestrial telecommunication is steadily embracing network programmability, with all the major terrestrial carriers incorporating Software Defined Networking (SDN) and Network Function Virtualization (NFV) as core strategic efforts to build more agile networks.

The same forces encouraging terrestrial companies to adopt network programmability also apply to satellite service providers. These forces are summarized by the demand for value-added services, the increasing complexity of networks, and increasing operational costs.

#1 – Demand for Value-Added Services

Telecommunications companies consistently rank customer experience management as the highest strategic priority to maintain differentiation over competitors. End users demand customer-centric approaches, so companies able to deliver highly tailored solutions while also reducing time to market not only achieve the best service offering, they gain a true competitive advantage.

In contrast, end users traditionally experience satellite communication as a cumbersome solution with limited options. Until satellite service providers become more agile and improve responsiveness, they will always be relegated to be an access technology of last resort. With an expected doubling of connected devices, the winners of this booming growth will be those companies that can meet emerging market requirements and quickly ramp deployment of services.

#2 – Increasing Network Complexity

Satellite communication has survived global economic slowdowns and the spread of cellular services. This consistent growth is projected to continue and may even accelerate given decreasing service costs and faster data rates. And the demand for value-added services is driving satellite service providers to aim for the same level of sophistication as traditional telecommunication companies.

Every additional site and each new service capability adds burden to the staff. But this burden is not merely linear… the more complex the network, the more exponential the curve. Every additional router, switch, line card, and remote multiplies interconnections to maintain. Enterprise firewalls and intrusion protection devices must be physically installed and configured per business customer. And the sheer number of users on a consumer network overwhelms any but the most streamlined operations.

#3 – Rising Operational Costs

The satellite communication industry faces a challenging transition as a large amount of capacity comes online. High Throughput Satellites (HTS) are dramatically increasing broadband capacity and forcing prices per Mbps downward. The industry is still adjusting to the new market dynamics.

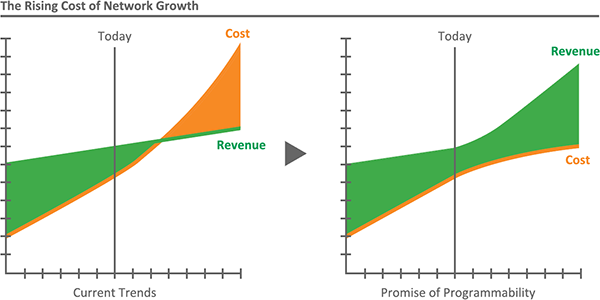

While the drop in the prices is encouraging existing customers to purchase faster data plans and growing the customer base, satellite operators and service providers are being squeezed between the amount of revenue collected per user and the cost of offering that service per user. So service providers face an unenviable position of having unlimited opportunity for growth, but the cost structure to sustain that growth means the opportunity is becoming less profitable.

Seeking a Way Forward

Given these three forces impacting the VSAT industry, either the cost of network deployment and management will eventually outstrip revenue gains, or service providers will need to find a way to lower costs while still delivering value added services. iDirect has written a special white paper to help satellite service providers gain a conceptual understanding about SDN and NFV, discover how this technology will be critical to future growth, and learn how companies can take the first steps forward toward adopting network programmability and virtualization.

Begin preparing for the SDN and NFV technology transition by downloading The Birth of Dynamic VSAT Services white paper.